Core Scientific Price Levels to Track After CoreWeave Bid Report

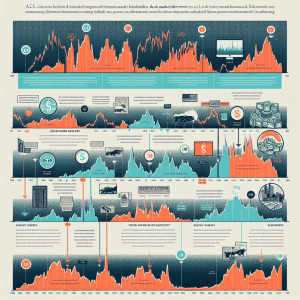

Core Scientific shares surged this week on news that Nvidia-backed CoreWeave negotiates a takeover of the Bitcoin mining and hosting provider. The stock completed a six month cup-and-handle base - broke above the pattern's upper boundary during Thursday's session.

The first resistance cluster aligns with the November peak at $18.65. A close above that level opens a path toward $27.30, the next supply zone. On any pullback, the shelf at $13 offers the first demand layer. A deeper retracement would target $10.50, the low from last June.

Core Scientific filed for bankruptcy in January 2023. The company emerged from Chapter 11 in January 2024. CoreWeave attempted a purchase in 2023 but the deal collapsed. The two companies now operate under hosting contracts worth several billion dollars. The Wall Street Journal reports that a definitive agreement may arrive within weeks.

Volume expanded during Thursday's 33 percent advance. The move pushed the stock to its highest close since November. Institutional footprints appeared in January 2024, when the stock broke above the $10.50 level on heavy turnover.

Traders who avoid momentum entries may wait for a return to the $13 pivot. That price coincides with the breakout point from the cup-and-handle pattern. A sustained hold above $18.65 would confirm the next leg higher toward $27.30.

The commentary, opinions along with analyses on this page serve informational purposes only.