Ether Price Drops After Spot ETF Debut

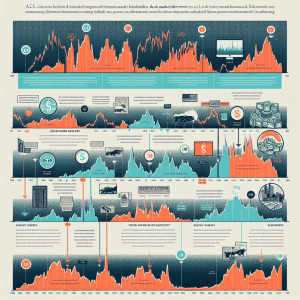

The native token of the Ethereum network, trades 3 % lower than its level on the first day of spot ether ETF trading in the United States. The slide traces to the Grayscale Ethereum Trust, a closed end fund that converted into an ETF on the same date. Holders of the legacy vehicle pay an annual fee of 2.5 %. Redemptions accelerated once cheaper ETF alternatives became available - forcing the trust to liquidate ether holdings and pressuring the spot price.

The pattern repeats the launch of spot bitcoin ETFs in January. The Grayscale Bitcoin Trust bled assets during the first two weeks of trading. Bitcoin fell 10 % over the same interval.

BlackRock digital assets head Mitchnik told reporters that client demand for crypto exposure concentrates on bitcoin and ether. Interest in other tokens remains negligible. He expects flows from large wealth managers to increase later in the year.

Although some capital rotated from the Grayscale trust into competing spot ether ETFs, the sector still records a net outflow of 406.4 million dollars since launch.

MV Capital partner Tom Dunleavy projects further departures through August - he wrote on the social media platform X that weekly outflows of roughly one billion dollars in ether equivalents should taper by the end of the month - establishing a new equilibrium price.

Analysts diverge on the trajectory once the Grayscale overhang clears. Bitwise chief investment officer Matt Hougan published a note earlier in the month that argued ether offers a technology based investment case distinct from bitcoin's monetary use thesis. Ethereum's programmable settlement layer faces competition from alternative smart contract networks, yet its developer base, application stack along with settlement volume remain the largest among programmable blockchains.